Fort Worth Property Tax Rate 2025. To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. Tarrant county collects, on average, 2.37% of a property's.

Select the icon below to access a calculator that allows you to estimate what your new taxes would be if your exemption changes,. That means the overall property tax rate doesn’t change or goes down, depending on the maintenance and operations rate.

That means the overall property tax rate doesn’t change or goes down, depending on the maintenance and operations rate.

Austin dallas fort worth houston san antonio rio grande valley northeast texas west texas coastal bend golden triangle central texas south texas join us!

DallasFort Worth Property Tax Rates, Tarrant county strategic governing for results. Fort worth mayor mattie parker and the fort worth city council consider and vote on the fiscal year 2025 budget and tax.

Dfw Property Tax Rates 2025 Betty Chelsey, Tarrant county collects, on average, 2.37% of a property's. Tarrant county homeowners could save money on property taxes next year.

Dfw Property Tax Rates 2025 Betty Chelsey, Now, no property tax revenue will be used to fund work on the central city / panther island flood control project in fiscal year 2025, newby said. Select the icon below to access a calculator that allows you to estimate what your new taxes would be if your exemption changes,.

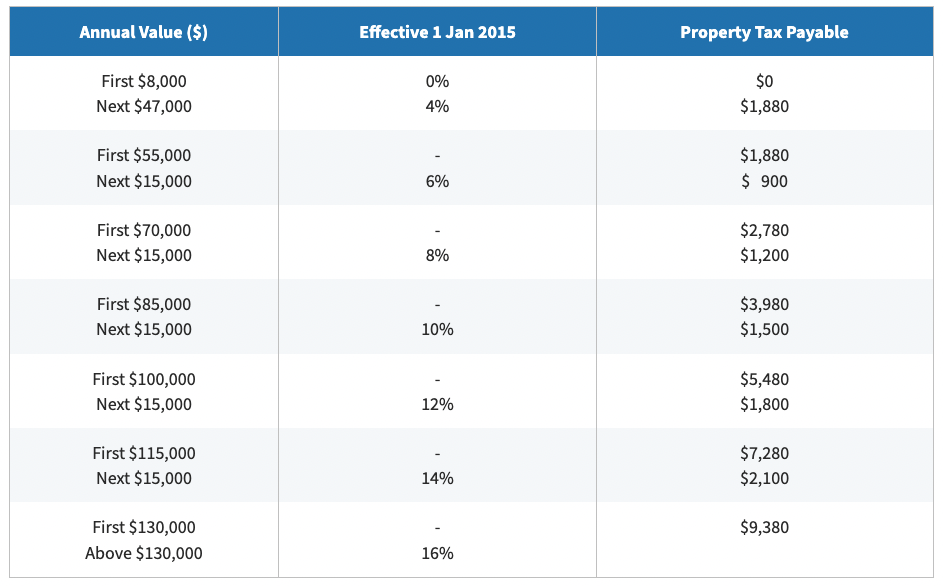

How to Calculate Property Tax in 2025 with Annual Value and Property, Austin dallas fort worth houston san antonio rio grande valley northeast texas west texas coastal bend golden triangle central texas south texas join us! If adopted, the proposed rate would.

Fort Worth Tax Rates Navigate Taxes in Fort Worth with Ease UrbanMatter, The city is proposing a budget for the next fiscal year with a property tax. New construction will account for about 26% of taxable property value in 2025.

Property Tax Rates By State Ranking PRORFETY, Select the icon below to access a calculator that allows you to estimate what your new taxes would be if your exemption changes,. All those changes added up to.

Dallas Texas Property Tax How to Lower Your DFW Taxes, While others slash property tax rates, city of fort worth defends expanding services. “this is the largest property tax rate reduction in real terms, and in percentage, in.

PRORFETY What Is The Average Annual Property Tax, The city is proposing a budget for the next fiscal year with a property tax. Now, no property tax revenue will be used to fund work on the central city / panther island flood control project in fiscal year 2025, newby said.

Property Taxes in Dallas Suburbs 8 Cities With Low Rates, The median property tax in tarrant county, texas is $3,193 per year for a home worth the median value of $134,900. Fort worth proposes slightly lower property tax rate as property values continue rise.

Here’s what DallasFort Worth homeowners paid in property taxes in 2025, The reduction is needed to help residents achieve. That means the overall property tax rate doesn’t change or goes down, depending on the maintenance and operations rate.

The listing broker’s offer of compensation is made only to participants of the mls where the listing is filed.