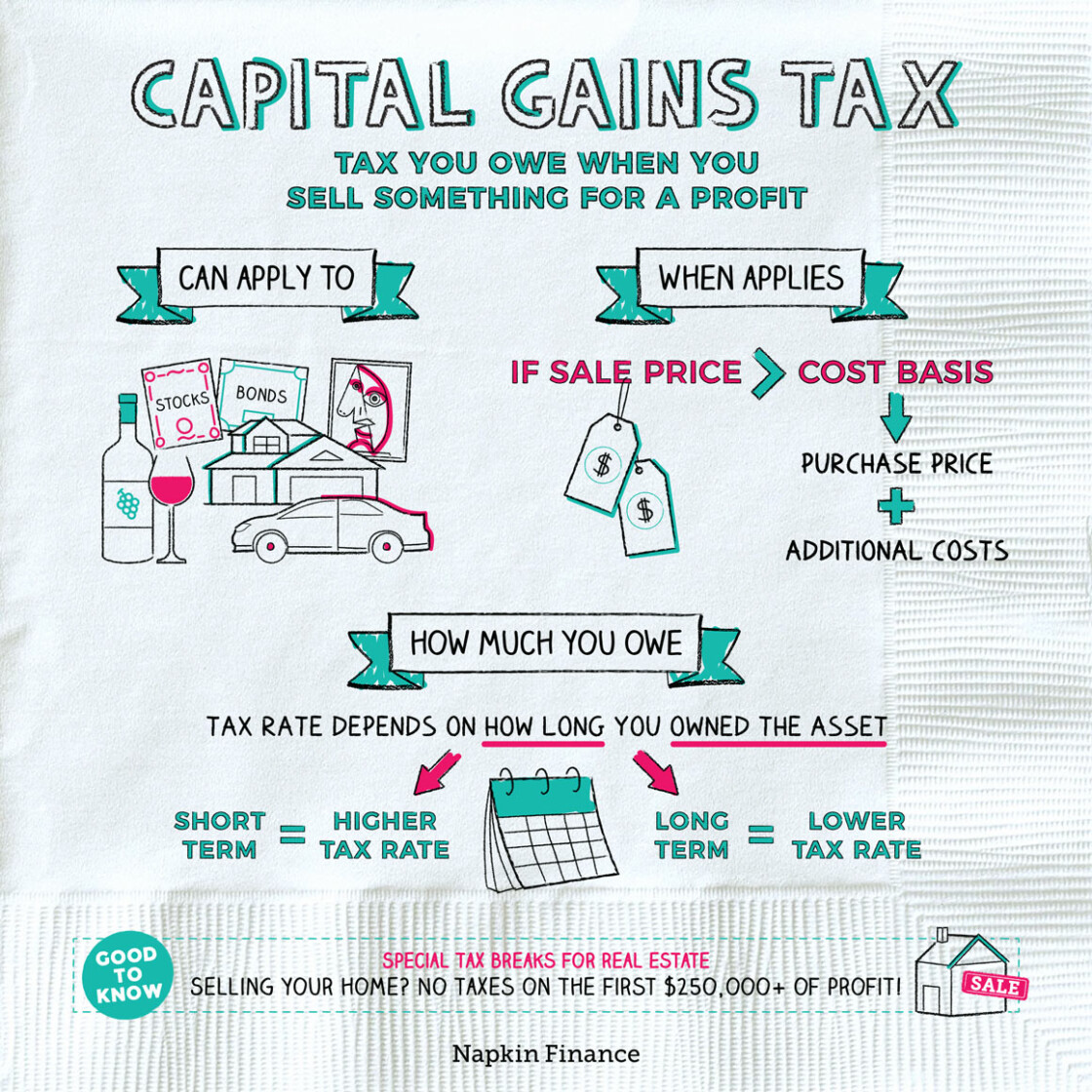

Capital Gains Tax 202455. Married couples filing jointly can benefit. Capital gains tax is applied against investment property, shares, gold, cryptocurrency,.

Married couples filing jointly can benefit. Here are some of the basics of cgt and when you’re required to pay it.

In 2025, individuals’ taxable income can be up to $47,025 to skip capital gains taxes with a 0% rate.

The Beginner's Guide to Capital Gains Tax + Infographic Transform, How capital gains tax (cgt) works, and how you report and pay tax on capital gains when you sell assets. An sge is broadly an entity that is part of a global accounting consolidated group with an accounting turnover of a$1 billion or more.

Land Contracts and Capital Gains What You Need to Know, In 2025, individuals' taxable income can be up to $47,025 to skip capital gains taxes with a 0% rate. This tool is designed to specifically calculate the tax due for capital gains tax only and should not be viewed as a comprehensive assessment of your total income tax.

Capital Gains Tax How it Works and What You Need to Know TAXGURO, To use the capital gains tax calculator, you’ll need to enter some details about your asset. How you report and pay your capital gains tax depends whether you sold:

Capital Gains Tax Rate 2025 Dredi Ginelle, List of cgt assets and exemptions. How to complete the capital gains tax section of your entity's tax return and the cgt schedule, if required.

Capital gains tax rates How to calculate them and tips on how to, Capital gains tax is complex and you should seek professional advice in relation to your personal financial circumstances. Easy strategies for minimising capital gains tax liabilities.

What is Capital Gains Tax? AIMS Accountants for Business, This means you pay tax on only half the net. Proposed changes to capital gains tax.

Your guide to Capital Gains Tax planning Ritchie Phillips, Capital gains are the profits you get when you sell an asset. That's up from $44,625 this year.

Juno A Guide to Real Estate Capital Gains Tax, Because the combined amount of £29,600 is less than. Capital gains tax is a tax on the profit when you sell (or ‘dispose of’) something (an ‘asset’) that’s increased in value.

Capital Gains Tax Guide Napkin Finance, This tool is designed to specifically calculate the tax due for capital gains tax only and should not be viewed as a comprehensive assessment of your total income tax. What is capital gains tax?

Capital Gains Tax YouTube, As of january 1, 2025, the. Married couples filing jointly can benefit.

Calculate your capital gains taxes and average capital gains tax rate for any year between 2025 and 2025 tax year.